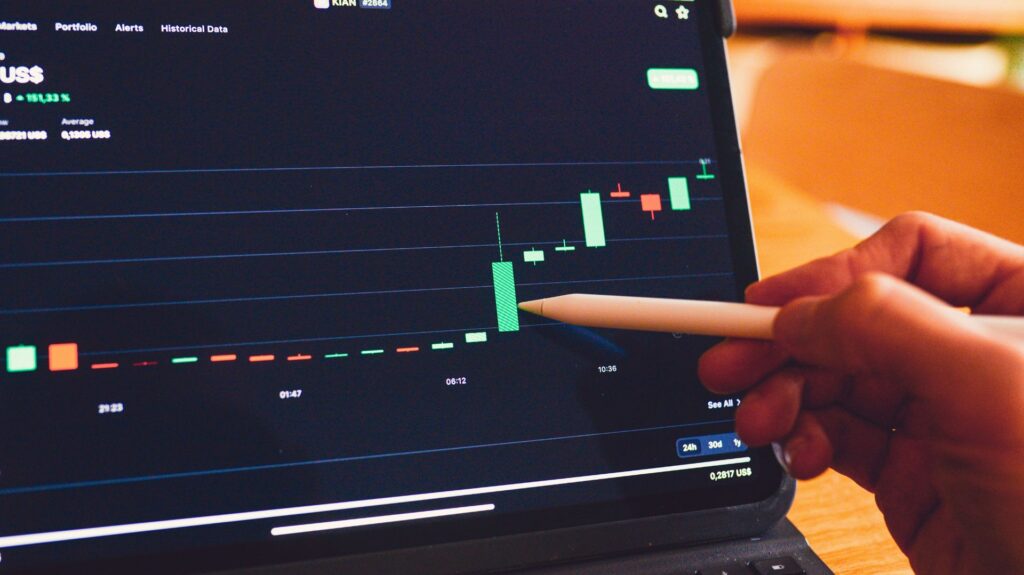

If you’re serious about improving your trading skills, understanding candlestick patterns is an essential first step. Candlesticks are more than just colorful bars on a chart — they represent price action, market psychology, and trader behavior. In this beginner-friendly guide, you’ll learn how to read candlestick patterns, recognize the most important formations, and apply them to real trades.

Candlestick patterns are visual representations of price movement over a specific period. Each candle reflects four key pieces of information: open, high, low, and close. When you learn to interpret these patterns, you can make smarter trading decisions based on momentum, trend strength, and potential reversals.

They help you identify market trends and reversals early

They improve entry and exit timing

They’re universally used by traders, from beginners to professionals

They can be combined with indicators for more accurate setups

Candlestick patterns fall into two major categories:

Bullish Patterns: Suggest the price may rise. Typically found at the bottom of a downtrend.

Bearish Patterns: Indicate potential price drops. Usually seen at the top of an uptrend.

Appears after a downtrend

Small body, long lower wick

Indicates buyers are gaining strength

Bullish: Green candle fully covers the previous red candle

Bearish: Red candle completely engulfs the previous green candle

Reliable on higher time frames like 1-hour or daily

Tiny or no body with long wicks

Shows indecision in the market

Use confirmation candle to trade

Three-candle pattern:

Red candle

Small-bodied candle (Doji or Spinning Top)

Strong green candle

Seen near support zones

Appears after an uptrend

Small body with long upper wick

Signals weakness in buying pressure

TradingView: Free charting tool with replay feature

Chartink: Pattern scanner for Indian stocks

Notion/Excel: For maintaining a candle journal with screenshots

Trading every pattern without confirmation

Ignoring volume or market context

Forgetting to use stop-losses

Overtrading based on just one signal

Always combine candlestick patterns with trend lines, support/resistance, and indicators like RSI or VWAP

Backtest strategies before using them in live trades

Practice daily and maintain a trade journal

Welcome to Trade4u, the official learning platform of Trade with Bhagyashri – where your trading journey begins with knowledge, confidence, and real market wisdom.