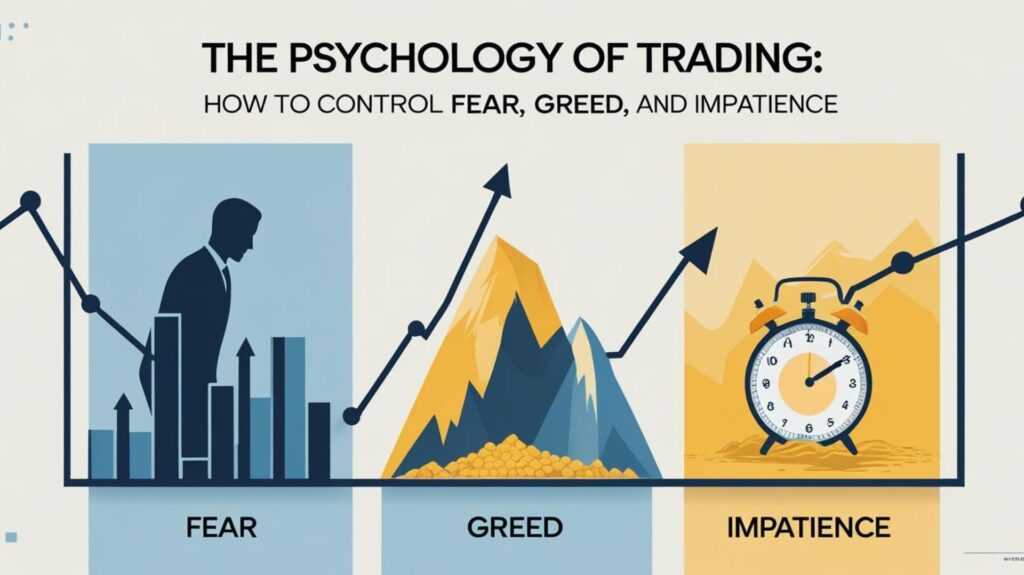

Trading isn’t just about technical analysis, charts, or market news — it’s equally about controlling your mindset. In fact, mastering trading psychology can be the difference between consistent profits and costly mistakes. If you’ve ever exited too early, held on too long, or entered impulsively — you’re not alone. These behaviors are emotionally driven.

This blog will help you understand how fear, greed, and impatience impact trading and how to conquer them for good.

Fear often shows up when:\n

You’re unsure of your strategy.

You’ve had a recent loss.

You’re risking too much capital.

Fear can lead to hesitation, missed opportunities, or exiting trades too early. To handle fear:

Backtest your strategy and build confidence in it.

Use smaller position sizes.

Stick to your stop-loss.

Greed makes traders:

Ignore exit points hoping for more profit.

Overtrade during a winning streak.

Double down on risky positions.

To keep greed in check:

Set realistic profit targets.

Journal your trades to analyze behavior.

Remind yourself: “Profit is profit — no one went broke booking gains.”

Impatience makes you:

Enter trades too early without confirmation.

Chase after every movement.

Get frustrated waiting for setups.

How to stay patient:

Use alerts to notify you of valid setups.

Avoid watching the screen all day.

Practice mindfulness or deep breathing to reduce anxiety.

Have a Plan: Entry, exit, stop-loss, risk-reward — write it all down.

Risk Management: Never risk more than 1–2% per trade.

Follow a Routine: Journal daily. Reflect weekly.

Accept Losses: Even the best traders lose sometimes.

Take Breaks: A calm mind is sharper than a stressed one.

At Trade with Bhagyashri, we don’t just teach charts — we teach mindset mastery. Our online & offline courses cover:

Trading psychology basics

Real-world examples from Indian markets

Guided emotional control techniques

The biggest enemy in trading isn’t the market — it’s your mind. Train your emotions like you train your strategy, and you’ll be ahead of most traders.

Welcome to Trade4u, the official learning platform of Trade with Bhagyashri – where your trading journey begins with knowledge, confidence, and real market wisdom.